Ultimate Guide to Tenant Income Verification for Landlords in

Welcome to the most comprehensive resource on tenant income verification designed specifically for landlords. Whether you’re a seasoned property owner or just starting out in real estate, verifying a prospective tenant’s income is a critical step in the screening process. This guide will equip you with all the how-to’s, techniques, legal insights, and practical tools to ensure your rentals are occupied by reliable tenants who can afford the rent.

In an era where economic fluctuations and rental fraud are on the rise, mastering income verification can significantly reduce risks like late payments, evictions, and financial losses.

Why Verify Tenant Income? The Foundation of Smart Landlord Practices

Tenant income verification isn’t just a box to check—it’s your first line of defense against rental risks. Landlords who rigorously verify income experience fewer instances of payment delinquencies.

In , with rising living costs and job market volatility, ensuring a tenant’s ability to pay rent is more crucial than ever.

Key Benefits for Landlords

- Risk Reduction: Verified income helps predict financial stability, minimizing evictions.

- Compliance and Fair Housing: Proper verification ensures adherence to fair housing laws.

- Fraud Prevention: Cross-checking documents spots fakes early.

- Better Tenant Relationships: Transparency builds trust and longer tenancies.

The standard rule: Rent should not exceed 30% of gross income. Verification enforces this objectively.

Protect your rental income with professional, verified tenant screening.

Order Your Tenant Screening Report NowFast, accurate reports including income insights, credit, criminal history, and eviction records.

Legal Considerations for Tenant Income Verification in

Navigating the legal landscape is essential to avoid lawsuits. In , key updates include ongoing expansions of source-of-income protections and full implementation of recent HUD rules.

Source-of-Income Protections

As of early , over 20 states and numerous cities prohibit discrimination against tenants using vouchers or other lawful income sources (e.g., Section 8). You must verify the income amount, not its source.

How-To: Comply with Source-of-Income Laws

- Standardize screening criteria for all applicants.

- Update forms to remove biased language.

- Document every step.

Recent HUD Updates (HOTMA and Beyond)

Key HUD rules, including HOTMA provisions like the passbook savings rate, are fully in effect as of , with streamlined verification processes.

Top Methods to Verify Tenant Income: Techniques and Best Practices

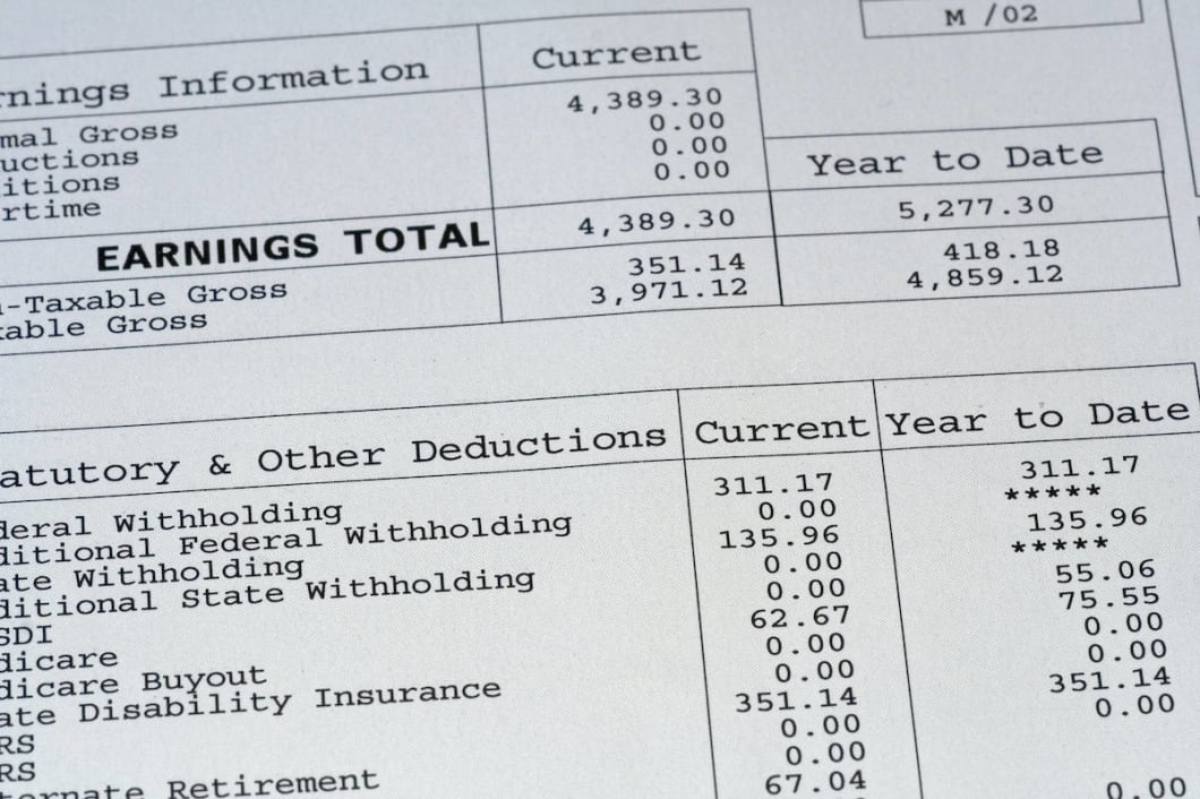

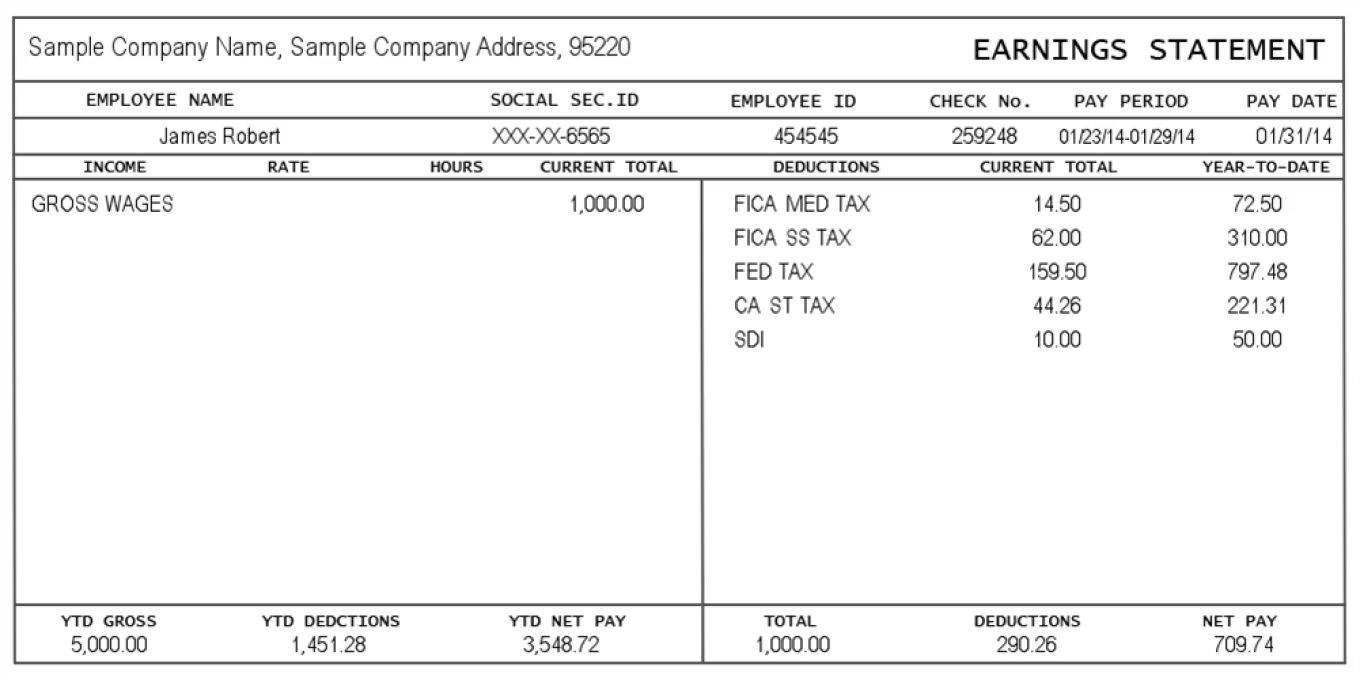

1. Pay Stubs and W-2 Forms

Pay stubs are the gold standard for salaried employees.

How-To: Verify Pay Stubs

- Request 2-3 recent pay stubs.

- Check consistency and spot red flags (e.g., inconsistent fonts).

- Calculate gross income.

2. Bank Statements

Ideal for gig workers or variable income.

How-To: Review Bank Statements

- Ask for 3-6 months.

- Verify deposits match claimed sources.

- Calculate average monthly income.

3. Tax Returns

Perfect for self-employed tenants. Focus on adjusted gross income (AGI).

4. Employment Verification Letters

Direct confirmation from employers.

How-To: Obtain and Verify

- Directly contact the employer using details provided on the application.

- Cross-reference with other documents.

5. Alternative Methods for Non-Traditional Income

For retirees: Social Security statements or pension letters.

Step-by-Step How-To Guide for Verifying Tenant Income

- Include consent in applications.

- Request specified documents.

- Review for consistency.

- Calculate rent-to-income ratio (ideally 3x rent).

- Use third-party tools if needed.

- Document everything.

Detecting Fake Documents: Advanced Techniques

Look for inconsistencies; use professional screening services for advanced fraud detection.

Professional Tools and Services

For the most reliable results, use comprehensive tenant screening reports that include verified income insights.

FAQs: Common Questions from Landlords

Q: Best way to verify income? Combine pay stubs, bank statements, and employer verification.

Q: Handling self-employed tenants? Tax returns and profit/loss statements.

Q: Current legal changes? Stay updated with expanding source-of-income laws and HUD compliance in .